Throughout your childhood, you may have grown up with a piggy bank perched on a dresser or shelf. From a very young age, we have been taught to save. Money from the tooth fairy, birthdays, collecting coins, money has always been taught as a valuable resource. While lots has changed since you last used your piggy bank (or maybe you still do!), money is still something that fuels our country. As children and teens mature, they are “taught” about money by having real-world experiences of buying items and evaluating prices. Although many have the experience of purchasing services and goods with the tool of money, teens who don’t immerse themselves in financial education face the consequences.

By definition, financial literacy is “the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing.” Financial Literacy equips teenagers with the resources for success. Educating oneself protects them from potential fraud, debt, and financial blindness, meaning unaware of financial situations, most commonly negative ones. Money is something that powers our country and daily lives. Strong knowledge of financial literacy in adolescents and adults is crucial to success in their future. According to the National Endowment for Financial Education (NEFE), 1 in 5 US teenagers lack basic finance skills.

Understanding interest, budgeting, debt management, credit, savings, and financial goals are all outcomes of financial literacy. When teenagers or even adults don’t understand these concepts, they put themselves at major risk.

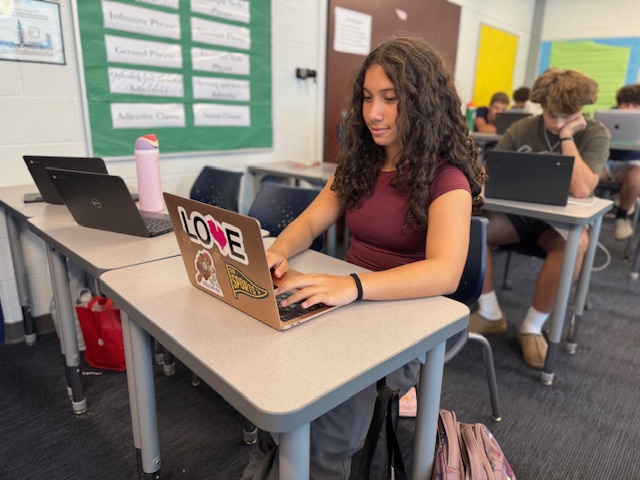

To encourage students to learn more about Personal Finance, Berkley High School holds a math class called ‘Personal Finance’ taught by teachers Rebecca Flood and Natalie Konwinski. Ms. Flood points out that while her students may only be 17 or 18 years old, “they will one day hope to retire. In order to do so, students need to understand what options are out there for them to set themselves up for success 30-40 years down the line. Things like the importance of investing, taking advantage of free money they may be able to get from their work retirement plans, or making sure they set up a retirement account on their own if one isn’t offered to them through work. When they set themselves up for success, they can continue to pass along these tips, and even some wealth, to their future generations.”

Financial literacy classes are growing in the US and are now more commonly seen in high schools. Ms. Konwinski says that, “heightened exposure to financial literacy can lead to increased wealth in the sense of an increase in personal wealth and an increased amount of wealthy individuals.” She further explains that exposure to financial education as kids and teenagers increases success and planning for the future. Ms. Flood and Ms. Konwinski both use online resources like budgeting tools, online banking tools, and investment apps to aid their teaching in the classroom.

To recap, students who engage themselves with financial literacy resources can increase their readiness and approach to adulting and saving. Being able to understand why money matters is an essential life skill that schools all across the world are adapting to. With all of this information, myself and your future self encourages you to check out some of the resources, and if you’re able, look to enroll in personal finance at BHS!

https://www.nerdwallet.com/calculator/compound-interest-calculator

https://www.forbes.com/advisor/banking/savings/clever-ways-to-save-money/